What is the European System of Financial Supervision?

The European System of Financial Supervision (ESFS) was set up in November 2010 in the wake of the financial crisis following the recommendations of a group of high-level experts led by Jacques de Larosière. This system was created to strengthen financial supervision, better protect European citizens and ultimately rebuild trust in the EU financial system.

The ESFS consists of:

- The three European Supervisory Agencies (ESAs) which supervise individual sectors and institutions (“micro-prudential” pillar);

- The European Systemic Risk Board (ESRB), which oversees the financial system as a whole and coordinates EU policies for financial stability (“macro-prudential” pillar).

What are the ESAs and what do they do?

The ESAs are the European Banking Authority (“EBA”), the European Insurance and Occupational Pensions Authority (“EIOPA”) and the European Securities and Markets Authority (“ESMA”). They contribute to developing a unified set of rules for EU financial markets, including in the area of anti-money-laundering. They also help to foster supervisory convergence among supervisory authorities, enhance consumer and investor protection as well as contributing to the fight against financial crime. The ESAs play a key role in ensuring that the financial markets across the entire EU are well regulated and supervised.

In particular the ESAs contribute to:

- improving the functioning of the single market for financial services, underpinned by sound, effective and consistent regulation and supervision;

- ensuring the integrity, transparency, efficiency and orderly functioning of financial markets;

- making anti-money laundering supervision more effective;

- strengthening supervisory coordination;

- preventing regulatory arbitrage and promoting equal conditions of competition;

- ensuring that risks in their respective sectors are appropriately regulated and supervised; and

- enhancing customer and investor protection.

2. Rationale for the proposals

What are the reasons for the Commission’s proposed changes to the supervisory framework?

The EU’s supervisory framework underwent a complete overhaul in the financial crisis, thanks to the establishment of the three European Supervisory Authorities for banking, capital markets and insurance and pensions, as well as the European Systemic Risk Board for the monitoring of macro-economic risks. Despite these important steps, the process of financial integration is a work in progress and needs to keep pace with developments both within the EU and at global level.

Having recovered from the financial crisis, the EU is moving ahead to complete the Banking Union (BU) and the Capital Markets Union (CMU). More integrated financial markets are beneficial for the EU as a whole, but are particularly important for the Economic and Monetary Union, as set out in the Reflection Paper on Deepening the Economic and Monetary Union of May 2017 and in the Five Presidents’ Report of June 2015.

As part of these broader efforts, decisive action must also be taken to ensure that anti-money laundering rules are effectively supervised across the EU and different authorities cooperate closely with each other.

To this end, the Commission proposed to further integrate and strengthen EU financial market supervision by reinforcing the coordination role of the ESAs and attribute new direct supervisory powers to ESMA. The Commission also proposed to strengthen the EBA’s role in the area of anti-money laundering. In order to fit their new tasks, the Commission also made changes to the ESAs’ governance and funding.

This reform constitutes a response to new opportunities and challenges in supervision, such as the increased importance of sustainable finance as well as the new developments in the area of financial technology (FinTech).

How were the proposals prepared?

The September 2017 proposals build on six years of operational experience with the ESAs, on almost 300 responses to the Commission’s public consultations of autumn 2016 (on the ESRB) and of spring 2017 (on the ESAs) and an intense dialogue with all relevant stakeholders. They also take into account the March 2014 recommendations of the European Parliament and the review report prepared by the Commission in August 2014.

In September 2018as part of a broader strategy to strengthen the EU framework for prudential and anti-money laundering supervision for financial institutions, the 2017 proposals were amended to introduce a set of targeted changes to the EBA founding Regulation and give EBA the necessary tools, governance and resources to ensure effective cooperation and convergence of supervisory standards in the area of anti-money laundering.

3. Key features of the agreement

Why an enhanced role for the EBA in the area of anti-money laundering?

While the EU has strong anti-money laundering rules in place, recent cases involving money laundering in some EU banks have raised concerns that those rules are not always supervised and enforced effectively across the EU. That is why the Commission proposed in September 2018 to further strengthen the supervision of EU financial institutions to better address money-laundering and terrorist financing threats.

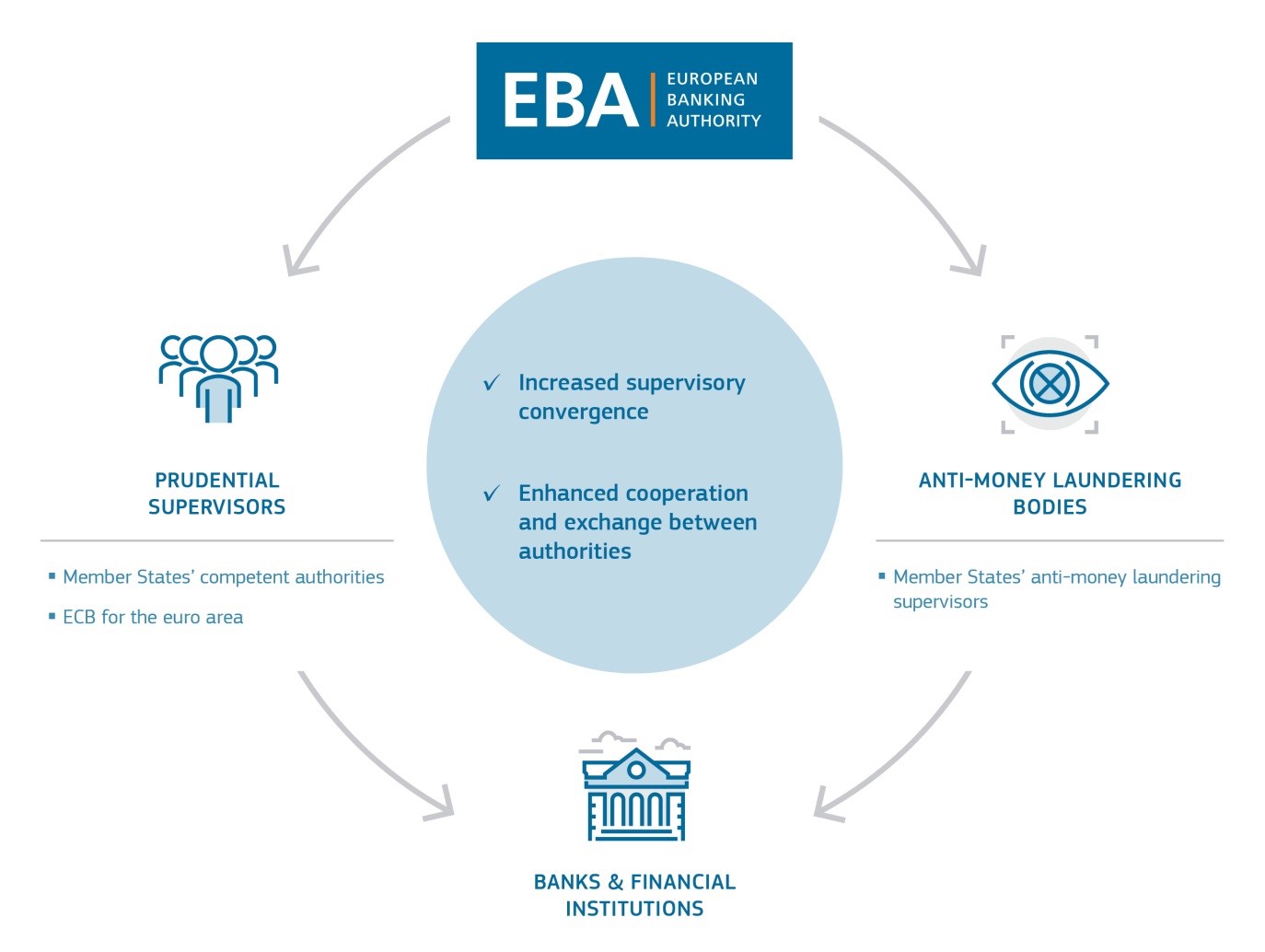

In particular, to ensure high quality anti-money laundering supervision and effective coordination among different authorities across all Member States, anti-money laundering responsibilities in the financial sector will be entrusted specifically to one of the three European Supervisory Authorities, namely the European Banking Authority (EBA), as it is in the banking sector that money-laundering and terrorist financing risks are the most likely to have a systemic impact. The new rules streghten the EBA’s role and give to the EBA the necessary tools and resources to ensure effective cooperation and convergence of supervisory standards.

What is the role of the European Banking Authority under the new rules?

The European Banking Authority (EBA) has been provided with a more explicit and comprehensive mandate to ensure that risks of money laundering and terrorist financing in the Union’s financial system are effectively and consistently incorporated into the supervisory strategies and practices of all relevant authorities.

The amended Regulation will:

- ensure that breaches of anti-money laundering rules are consistently investigated: the EBA will be able to request national anti-money laundering supervisors to investigate potential material breaches and to request them to consider targeted actions – such as sanctions;

- provide that the national anti-money laundering supervisors comply with EU rules and cooperate properly with prudential supervisors. The EBA’s existing powers will be reinforced so that, as a last resort if national authorities do not act, the EBA will be able to address decisions directly to individual financial sector operators;

- enhance the quality of supervision through common standards, periodic reviews of national supervisory authorities and risk-assessments;

- enable the collection of information on anti-money laundering risks and trends and fosterng exchange of such information between national supervisory authorities (so-called data hubs);

- facilitate cooperation with non-EU countries on cross-border cases;

- establish a new permanent committee that brings together national anti-money laundering supervisory authorities;

- Ensure that the EBA will have enough resources to carry out these new tasks.

These amendments will bring major improvements to the supervisory framework of anti-money laundering risks and contribute to risk reduction in the financial sector.

How will the three European Supervisory Authorities cooperate in the fight against anti-money laundering and terrorist financing?

A dedicated committee will be established within the EBA to prepare decisions relating to money laundering and terrorist financing measures (comparable to the existing EBA bank resolution committee). It will be composed of high-level representatives of national supervisory authorities responsible for ensuring compliance with laws against money laundering and terrorist financing as well as high-level representatives of the three ESAs. In decisions relating to matter under the competence of ESMA or EIOPA the EBA final decision will be taken in agreement with ESMA or EIOPA respectively.

How do the proposals strengthen the convergence of supervisory practices within EU banking, insurance and capital markets?

The agreement equips the three ESAs with new and improved instruments to foster convergence in the way the European financial sector is supervised. The convergence efforts of all ESAs will particularly profit from the following elements of the agreed rules:

- In the future, the assessment of the work of national supervisors (the so-called “peer reviews”) will be headed and carried out by ESA staff and representatives of competent authorities. More transparency has been introduced through reporting requirements.

- The coordination groups of the ESAs and competent authorities, currently voluntary, will be institutionalised to work on concrete cases. Once a group is established upon request of at least by 5 Board of Supervisor members, all national supervisors have to attend and to contribute.

- A more pan-European supervisory view will be developed by enabling the ESAs to define up to 2 supervisory topics all national supervisors should focus in their respective work programmes.

In addition, EIOPA will be entrusted with more specific tools for fostering supervisory convergence in the field of insurance:

- The possibility for EIOPA to assist national supervisors in the use and authorisation of internal models will help to achieve more convergent outcomes. Internal models are used by insurance companies to calculate requirements on solvency capital. Despite ongoing efforts, there are currently still major inconsistencies across the EU.

- With the introduction of so-called collaboration platforms and improved information exchange between the different supervisors of insurance firms operating cross-border, EIOPA will also be able to promote convergent supervisory practices within the Single Market and assist competent authorities to protect insurance policy holders in cross-border disputes.

How will the agreed proposals contribute to more integrated and better supervised capital markets?

Well-integrated capital markets are essential for the financing of the EU’s real economy, for a well-functioning Capital Markets Union and act as important shock-absorbers in the Economic and Monetary Union. Integrated capital markets facilitate private risk-sharing across borders, while conversely also reducing the potential need for public risk-sharing. More integrated supervision at EU level also means fewer costs and obstacles for financial firms that wish to expand within the EU and more choice for consumers. In addition, integrated supervision reduces the risk of regulatory arbitrage, ensuring the same standard of supervision for non-EU players who can also benefit from a single point of entry in the EU.

On this basis, the agreement extends ESMA’s direct supervision to some specific areas of capital markets. In particular, ESMA will directly supervise specific sectors which are highly integrated, have important cross-border activities and which are, in most cases, regulated by directly-applicable EU law.

- Market Abuse

ESMA will have a greater coordinating role in market abuse cases. Where certain orders, transactions or behaviours give rise to suspicions of market abuses and have cross-border implications for the integrity of financial markets or financial stability in the EU, ESMA will be able to issue an opinion on the appropriate follow-up. These new powers are in line with ESMA’s mandate to ensure the orderly functioning of markets and financial stability.

- EU critical benchmarks

These are indices or indicators used to price financial instruments and financial contracts or to measure the performance of an investment fund. ESMA will authorise and supervise administrators of benchmarks that are deemed to be critical (such as EURIBOR and EONIA) at EU level and will also recognise non-EU administrators of benchmarks used in the EU.

- Data reporting service providers (‘DRSPs’)

Data reporting service providers enable the reporting of transactions in financial instruments to regulators and to the public. Centralising the authorisation and supervision of these operators with ESMA (except for those providers that benefit from a derogation for a lack of an EU-footprint) will reduce fragmentation and costs and should ensure the same quality and reliability of data across the EU.

How will the proposals strengthen consumer protection?

Better-functioning supervision will help the EU financial sector fulfil its primary objective of channelling savings to productive investments, and thus support economic growth. It will enhance the confidence of consumers, investors and businesses. At a general level, the reformed supervisory system will better protect users of financial services, including through greater convergence of conduct-of-business supervision. It will also facilitate access to finance by strengthening the resilience and preventing the failure of individual financial institutions.

In addition to an increased focus on consumer-related work, important new powers in the current consumer protection toolbox of the ESAs include:

- the ability to use the product intervention power also for practices and products that cause consumer harm (after two prolongations of six months, an automatic one-year prolongation of the prohibition is possible);

- the ability to promote EU-level coordination of mystery shopping (a method available to some supervisors to check market operators’ compliance with regulation) and thereby create cross-border efficiencies;

- an expanded scope of the EBA (consumer credit directive and the payment account directive) will allow it to look at consumer issues across a range of activities, for example not just deposits but also to lending practices as well.

What are the improvements for market participants and national supervisors?

- Market participants

The reform should lead to more convergent and hence improved supervision, including across borders and across sectors and this should reduce compliance costs thanks to more harmonised standards and supervisory practices. It should also further improve the level playing field among different domestic firms, firms operating across the Single Market and firms operating from third countries. For administrators of critical EU benchmarks and most DRSPs there will be a one stop shop for authorisation and supervision.

A new specific provision requiring the ESAs to have in place dedicated reporting channels for receiving and handling information provided by a natural or legal person reporting on actual or potential breaches, abuse of law, or non-application of Union law should increase transparency and contribute to improved enforcement of EU rules.

Finally, the emphasis put on taking into account new developments in relation to FinTech or sustainable finance will ensure that supervisors are fully up to speed with market developments, which will help supervised firms to anticipate and adjust to new trends and maintain a competitive edge.

- Proportionality in relation to supervisory convergence

In relation to their supervisory convergence mandate, the reform emphasises that the ESAs should take into account the nature, scale and complexity of the risks inherent in the business of the financial institutions and or market participants that are affected by their convergence measures.

- Alert and convergence system

Market participants will also benefit from the new “alert and convergence system” which will ensure that the ESAs in exceptional circumstances and when there are significant issues raised by legal acts (e.g., rules that conflict with each other; absence of a delegated or implementing act that raises legitimate doubts about the legal consequences of the level 1 act; absence of guidelines that makes application of the act difficult) alert the Commission and competent authorities about what those issues are and where necessary issue an opinion to ensure convergent enforcement practices in relation to the issues raised.

- National supervisors

The reform does not change the strong role for national authorities in many areas of supervision, as well as their experience and know-how in the ESAs governance. At the same time, the reform should improve the ability of national authorities to maintain the necessary standards of financial supervision, by reassuring them that similar supervisory standards and practices are applied in all other EU Member States. Finally, support by the ESAs will help national supervisors promote sustainable finance and stay up to speed with FinTech and other new developments.

How will the ESAs promote sustainable finance?

The financial sector has a vital role to play in reaching the climate change goals of the Paris Agreement and the EU’s 2030 Agenda for sustainable development. It is also essential that more private capital is mobilised towards green and sustainable investment so as to enable the transition to a low-carbon economy.

The agreement defines for the first time how the ESAs should integrate environmental, social and governance (ESG) criteria into their work: the ESAs are tasked to monitor the developments of ESG factors and to take into account these factors in all their activities. In this context, the ESAs can contribute to more coordinated ESG supervision of across the EU financial sector. Concretely, the ESAs are also mandated to further develop the current stress-testing by creating dedicated methodologies to consider potential environmental risk for the financial stability and to include this angle in the recurring stress testing of financial firms. This will enable the ESAs to monitor how financial institutions identify, report and address risks that ESG factors may pose to financial stability, thereby making financial markets activity more consistent with sustainable objectives. Finally, the ESAs will also provide guidance on how EU financial legislation can integrate sustainability considerations and promote the implementation of these rules.

How will the ESAs promote FinTech?

Financial Technology (FinTech) is transforming financial services. It facilitates access to financial services and makes them more convenient. It increases operational efficiency and can lower costs for consumers. It may also lower barriers for new market players and increase competition. For these benefits to happen, it is important to ensure the integrity and resilience of IT systems, data protection, and fair and transparent markets.

As financial services become more technology and data dependent, regulators and supervisors must be familiar with these technologies and be able to accommodate them. As part of the Capital Markets Union, the Commission has set out a comprehensive strategy setting detailing actions that must be taken to address these challenges and allow for an integrated market for digital financial services without constraints to economies of scale and scope.

As a first step in that direction, the ESAs will now have to take account of all issues related to technological innovation while carrying out their tasks. This will require them to enhance a common EU supervisory culture as regards technological innovation among competent authorities. In particular, the ESAs has been tasked with coordinating national technological innovation instruments and tools – such as innovation hubs or ‘sandboxes’ – set up by national supervisors. Furthermore, the ESAs will promote technology literacy with all national supervisors alongside information sharing on cyber threats, incidents and attacks. Through more coordinated approaches towards cybersecurity and resilience measures, the ESAs will also contribute to enhancing the security and integrity of the European financial sector.

How is the governance of the ESAs changed and how will this contribute to achieving their objectives?

The ESAs must be equipped with a governance structure which allows decisions to be taken quickly in the European interest while integrating the knowledge and experience of national supervisors. Under the agreed rules, national supervisors will continue to set overall directions and decide on regulatory matters within the Boards of Supervisors in each ESA. However, the mandate of the Chairperson, appointed by the Council after confirmation by the European Parliament, will be strengthened significantly in order to better steer the agenda of the ESA Boards. This includes a strengthened role in overseeing investigations and in case-by-case decisions regarding certain supervisory matters, such as dispute settlements and breach of Union law proceedings, eventually proposing decisions for the Board of Supervisors’ consideration.

How will the increased tasks of the ESAs be funded?

Adequate resources are key for the effectiveness of the improved EU supervisory architecture and show a political commitment to provide the ESAs with the financial means needed for the new tasks.

The Commission had proposed that industry and market participants that benefit from the ESAs work should contribute to their funding. This proposal was not retained by the co-legislators, which means that the current funding system will continue to apply with minor additions that will allow the ESAs to charge for publications, training and for any other services specifically requested by one or more supervisors. The agreed rules will also allow the ESAs to accept voluntary contributions from Member States or observers as long as these contributions do not put the independence of the ESAs into question.

The agreement will however ensure a significant increase in the resources of the ESAs including for employing highly-qualified staff who will help the ESAs in their work to promote supervisory convergence, directly supervise specific financial sectors and to prevent the use of the financial system for the purposes of money laundering and terrorist financing. For all three ESAs, the Commission made a detailed estimation of the resources required to make stronger supervision work. This is set out in the legislative financial statement accompanying the proposal.

4. Review of the European Systemic Risk Board (ESRB)

What are the main features of the agreement on the amendment of the ESRB Regulation?

The agreement reached on the amendment of the ESRB Regulation will lead to the following main and targeted changes:

- ESRB Chair:

The ESRB has been chaired by the President of the European Central Bank (ECB). This set-up was initially envisaged for a period of five years. The ECB President has conferred authority and credibility to the ESRB and ensured that it can effectively build and rely on the expertise of the ECB in the area of financial stability. Under the agreement, the ECB President will become the permanent chair of the ESRB.

- Internal governance of the ESRB:

The role of the Head of the ESRB Secretariat will be strengthened by changing her or his selection procedure and clarifying her or his role. Furthermore, the roles of the ESRB Vice-Chairs will be strengthened. Vice-Chairs and Head of Secretariat may play a bigger role in the external representation of the ESRB, thereby raising its visibility.

- ESRB membership:

Under the agreement, the Single Supervisory Mechanism (SSM) and the Single Resolution Board (SRB) will become members of the ESRB General Board without voting rights. Corresponding adjustments will also be made to the Advisory Technical Committee.

The agreement provides Member States with conditional and framed flexibility as regards the nomination of the national member on the ESRB General Board with voting rights. In particular, Member States will have the possibility to nominate a high-level representative from a national designated authority ‑ i.e. an authority specifically designated for the application of macro-prudential instruments included in EU law (CRR/CRD) – on the condition that the national central bank is not the national designated authority. National Central Banks will always remain General Board members (either as voting or non-voting members). This flexibility allows to better reflect the existing diversity in national macro-prudential frameworks and to ensure that the Member States are represented by the most appropriate authority or body. No member of the General Board shall have a function in the central government of a Member State.

- Addressees of warnings and recommendations

The agreement broadens the list of potential addressees of ESRB warnings and recommendations. The ECB is specifically included for its tasks conferred by the SSM Regulation as regards micro- and macro-prudential supervision, i.e. not pertaining to the conduct of monetary policy. Further, the national resolution authorities (established by BRRD) and the Single Resolution Board are explicitly included on the list.

- Better Regulation, accountability and transparency:

In line with Better Regulation principles and where appropriate, the ESRB’s advisory committees are expected to consult interested parties such as market participants, consumer bodies and experts, to inform their opinions, recommendations and decisions.

It is further clarified that the General Board may decide to make an account of its deliberation public.

More information

Press release on the political agreement of 21 March 2019

Follow this news feed: EU