EU Finance Ministers welcome rapid EIB response to COVID-19 crisis

- EIB highlighted as key to mitigating economic and social impact of COVID

- President Hoyer confirms COVID response and climate action priorities for year ahead

- Slovakian Finance Minister Eduard Heger to be new chair of EIB Board of Governors

European finance ministers today welcomed the European Investment Bank’s EUR 240 billion rapid response to mitigate the impact of the COVID-19 crisis across Europe and around the world.

EIB COVID-19 response strengthening business resilience, research and public health

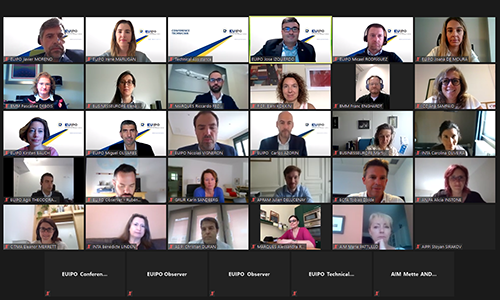

At the Annual Meeting of the EIB Board of Governors, meeting for the first time by video conference, finance ministers highlighted the significant impact of the EU Bank’s immediate response to mobilise EUR 40 billion of new investment since the start of the COVID-19 crisis and recent agreement to mobilise EUR 200 billion through the new pan-European Guarantee Fund identified as crucial for reducing the economic impact of the pandemic.

Finance Ministers further highlighted the key contribution of accelerated support for public health infrastructure and vaccine development, and strengthened engagement to provide EUR 5.2 billion of new support for priority investment by global partners at this time of need as part of Team Europe’s response.

“As the EU bank, the EIB invests in Europe’s future. We are committed to mitigating against the economic fallout caused by the COVID-19 pandemic both inside and outside the Union, while remaining steadfast in delivering climate action and ensuring a more sustainable future in Europe and our 160 countries of operation around the world. The firm backing of Europe’s finance ministers today is testament to the strong results of the bank over the past year, and this support remains the cornerstone of the bank’s future success,” said Werner Hoyer, President of the European Investment Bank.

Finance Ministers confirm EIB strategic priorities

The Board of Governors discussed developments affecting the EIB over the last year and key strategic issues for the EU Bank’s future engagement including Brexit, best-banking practice and scaling up investment under the new EU budget, including Invest EU.

New chair of Board of Governors

The European investment Bank Board of Governors comprises the 27 European Union finance ministers and was chaired by Slovenian Finance Minister Andrej Šircelj.

For the next 12 months the Board of Governors will be chaired by Eduard Heger, Minister of Finance of the Republic of Slovakia.

“The European Investment Bank Group plays a unique role supporting long-term investment that improves lives and opportunities across Europe and around the world. It is an honour to be the new Chairman of the EIB Board of Governors and I look forward to working with fellow finance ministers and the EIB to ensure that the EU Bank’s financial strength and technical expertise support Europe at this time of need.” said Eduard Heger, Minister of Finance of the Republic of Slovakia.

“My colleagues and I are grateful for the close contribution of Finance Minister Andrej Šircelj during the last 12 months and we look forward to working closely with Minister Eduard Heger over the coming year.” added President Hoyer.

The Luxembourg based European Investment Bank is the world’s largest international public bank and last year the European Investment Bank Group provided EUR 72.2 billion of new financing that supported EUR 280 billion of new investment in 1095 projects across Europe and around the world.