ESMA has launched an assessment of the supervisory response in the financial reporting area by BaFin and the Financial Reporting Enforcement Panel (FREP) to the events leading to the collapse of Wirecard AG.

It will be completed by 30 October 2020.

High quality financial reporting is core to investor trust in capital markets and Wirecard’s collapse has undermined this trust. Therefore, it is necessary to assess these events to help in restoring investor confidence.

For further information, please visit our webpage here.

ESMA has published the results of its third stress test exercise regarding Central Counterparties (CCPs) in the European Union (EU) which confirm the overall resilience of EU CCPs to common shocks and multiple defaults for credit, liquidity and concentration stress risks.

The credit stress test highlighted differences in resilience between CCPs under the selected market stress scenario, although no systemic risk has been identified. Similarly, the liquidity stress test showed EU CCPs to be resilient under the considered scenarios and did not reveal any systemic risk.

For further information, visit our webpage here.

On 13 July ESMA began to receive reports from trade repositories (TRs) as the new reporting regime for financial and non-financial market participants under the Securities Financing Transactions Regulation (SFTR) began. The initial phase has gone smoothly.

Next steps:

ESMA will continue to engage with market participants to clarify any remaining issues and will assess the need for further supervisory convergence measures to facilitate compliance with the new reporting requirements.

Our LinkedIn Blogpost provides further details.

ESMA has published on 2 September its second Trends, Risks and Vulnerabilities (TRV) Report of 2020.

The Report analyses the impact of COVID-19 on financial markets during the first half of 2020 and highlights the risk of a potential decoupling of financial market performance and underlying economic activity, which raises the question of the sustainability of the current market rebound.

A webinar open to the public will be held on 9 September to present the report.

Following an open selection process, the Board of Supervisors has submitted to the European Parliament its selected candidates:

The selected candidates are:

1. Chair of the CCP Supervisory Committee:

Mr Klaus Löber, currently Head of the Oversight Division at the European Central Bank (ECB);

2. Two positions of Independent Member of the CCP Supervisory Committee:

Ms Nicoletta Giusto, currently Senior Director and Head of International Relations at Commissione Nazionale per le Società e la Borsa (CONSOB); and

Ms Froukelien Wendt, currently Senior Financial Sector Expert at the International Monetary Fund (IMF).

Important consultations closing this month

Speaking appearances by ESMA staff in September

Vacancy Notices

Open vacancies & deadlines

| Traineeship notice – Transversal profile (F/M) |

31/12/2020 |

| Traineeship notice – Legal profile (F/M) |

31/12/2020 |

| Traineeship notice – Financial Markets Profile (F/M) |

31/12/2020 |

| RIS Team Leaders – Ratings, Indices and Securitisation Department |

14/09/2020 |

All open vacancies can be found on ESMA’s recruitment portal

Missed any ESMA publications? Check out the full list of news items on our website.

|

1 September

ESMA publishes Call for Evidence in the context of the review of transparency requirements for equity and non-equity instruments

|

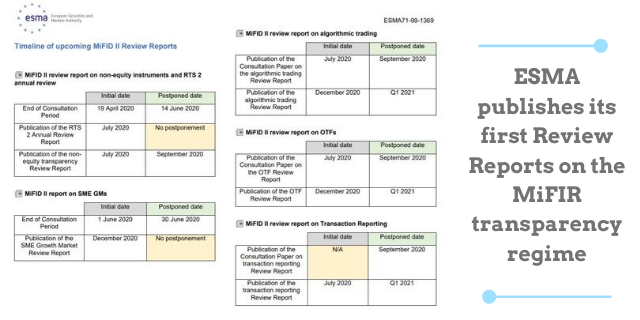

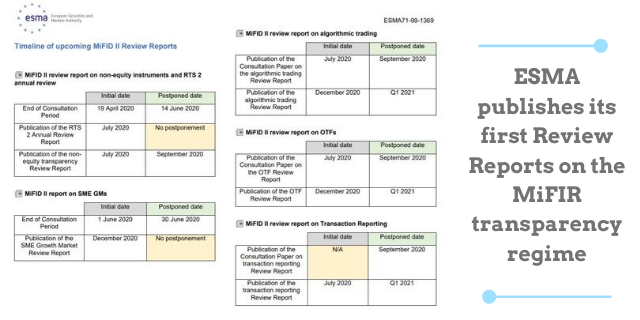

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published a Call for Evidence (CfE) in the context of its intention to review Commission Delegated Regulation (EU) No 2017/587 (RTS 1) and Commission Delegated Regulation (EU) No 2017/583 (RTS 2) starting from Q4 2020-Q1 2021. RTS 1 and RTS 2 contain the main implementing measures in respect of the MiFID II/MiFIR transparency regime for equity and non-equity instruments. |

|

31 August

ESMA publishes list of thresholds for shareholder identification

|

The European Securities and Markets Authority (ESMA), the EU’s securities and markets regulator, has published a document listing the thresholds above which shareholders can be identified in the various Member States of the European Union (EU). |

|

28 August

ESMA PROPOSES TO FURTHER POSTPONE CSDR SETTLEMENT DISCIPLINE

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published a final report on draft regulatory technical standards (RTS) definitively postponing the date of entry into force of the Commission Delegated Regulation (EU) 2018/1229 (RTS on settlement discipline) until 1 February 2022. |

|

27 August

ESMA selects Chair and Independent Members for its CCP Supervisory Committee

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has selected the candidates for the CCP Supervisory Committee set-up under the amended European Market Infrastructure Regulation (EMIR 2.2). |

|

27 August

Risk parameters in ESMA’s guidelines on stress test scenarios under the Money Markets Fund Regulation to be updated

|

The European Securities and Markets Authority (ESMA), the EU securities markets regulator, today confirmsthat the 2019 Guidelines on stress test scenarios under the Money Market Funds Regulation (MMFR) will be updated in 2020 to include a modification of the risk parameters to reflect recent market developments related to the COVID-19 crisis. |

|

19 August

ESMA provides updated XML schema and reporting instructions for securitisation reporting

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets’ regulator, has published updated reporting instructions and XML schema (version 1.2.0) for the templates set out in the technical standards on disclosure requirements. The updates address technical issues identified by stakeholders since December 2019. |

|

19 August

ESMA recommends priority topics in AIFMD review

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has written to the European Commission (Commission) highlighting areas to consider during the forthcoming review of the Alternative Investment Fund Managers Directive (AIFMD). |

|

07 August

ESMA ISSUES LATEST DOUBLE VOLUME CAP DATA

|

The European Securities and Markets Authority (ESMA), the EU’s securities and markets regulator, has updated its public registerwith the latest set of double volume cap (DVC) data under the Markets in Financial Instruments Directive (MiFID II). |

|

06 August

ESMA AGREES POSITION LIMITS UNDER MIFID II

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published twelve opinions on position limits regarding commodity derivatives under the Markets in Financial Instruments Directive and Regulation (MiFID II/MIFIR). |

|

04 August

ESMA IS SEEKING SECONDARY MARKET EXPERTS TO JOIN ITS CONSULTATIVE WORKING GROUP

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, is opening the call for expression of interest to renew the composition of the Consultative Working Group (CWG) of the ESMA Secondary Markets Standing Committee (SMSC). Experts are asked to send their application by 14 September. The members of the CWG are selected for a two-year renewable term. |

|

31 July

ESMA publishes data for the systematic internaliser calculations for equity, equity-like instruments, bonds and other non-equity instruments

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published data for the systematic internaliser quarterly calculations for equity, equity-like instruments, bonds and, for the first time, for other non-equity instruments under the Markets in Financial Instruments Directive (MiFID II) and Regulation (MiFIR). |

|

31 July

ESMA makes new bond liquidity data available

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has made available new data for bonds subject to the pre- and post-trade requirements of the Markets in Financial Instruments Directive (MiFID II) and Regulation (MiFIR) through its data register. |

|

31 July

EBA and ESMA launch consultation to revise joint guidelines for assessing the suitability of members of the management body and key function holders

|

The European Banking Authority (EBA) and the European Supervisory Market Authority (ESMA) launched a public consultation on their revised joint Guidelines. This review reflects the amendments introduced by the fifth Capital Requirements Directive (CRD V) and the Investment Firms Directive (IFD) in relation to the assessment of the suitability of members of the management body. The consultation runs until 31 October 2020. |

|

31 July

ESMA makes new bond liquidity data available

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has made available new data for bonds subject to the pre- and post-trade requirements of the Markets in Financial Instruments Directive (MiFID II) and Regulation (MiFIR) through its data register. |

|

31 July

EBA and ESMA launch consultation to revise joint guidelines for assessing the suitability of members of the management body and key function holders

|

The European Banking Authority (EBA) and the European Supervisory Market Authority (ESMA) launched a public consultation on their revised joint Guidelines. This review reflects the amendments introduced by the fifth Capital Requirements Directive (CRD V) and the Investment Firms Directive (IFD) in relation to the assessment of the suitability of members of the management body. The consultation runs until 31 October 2020. |

|

31 July

ESMA withdraws registration of NEX Abide Trade Repository AB

|

The European Securities and Markets Authority (ESMA), the EU’s Securities Markets Authority, has withdrawn the trade repository (TR) registration of NEX Abide Trade Repository AB (NATR). |

|

28 July

ESMA submits opinion to European Parliament on 2018 discharge process

|

ESMA submitted an Opinion on the European Parliament’s (EP) observations made in the 2018 discharge process. The Opinion sheds light on concrete actions taken by ESMA, including in relation to supervisory fees for credit ratings agencies and trade repositories, establishing the Proportionality Committee, on investigating dividend arbitrage trading schemes. |

|

28 July

ESMA updates transparency opinions for 3rd country venues

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has updated the list of third-country venues (TCTV) in the context of the opinion on post-trade transparency under MiFIR, following new requests from the industry. |

|

28 July

ESMA is preparing a new RTS to further postpone CSDR settlement discipline

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, is working on a proposal to possibly delay the entry into force of the CSDR settlement discipline regime until 1 February 2022. This is due to the impact of the COVID-19 pandemic on the implementation of regulatory projects and IT deliveries by CSDs and came as a request from the European Commission. |

|

23 July

ESMA publishes the MiFID/MiFIR Annual Review Report

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published the MiFID/MiFIR Annual Review Report under Commission Delegated Regulation (EU) 2017/583 (RTS 2). This report lays down the thresholds for the liquidity criterion ‘average daily number of trades’ for bonds, as well as the trade percentiles. |

|

21 July

ESAs notify the European Commission about the outcome of the review of the PRIIPs key information document

|

The European Supervisory Authorities (ESAs) have informedthe European Commission of the outcome of the review conducted by the ESAs of the key information document (KID) for packaged retail and insurance-based investment products (PRIIPs). |

|

21 July

ESMA recommends supervisory coordination on accounting for COVID-19-related rent concessions

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has issued a Public Statement recommending coordination of supervisory action with regards to issuers’ accounting for COVID-19-related rent concessions. |

|

17 July

ESMA tells market participants to continue preparations for the end of the UK transition period

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, urges financial market participants to finalise preparations and implement suitable contingency plans in advance of the end of the United Kingdom’s (UK) transition period on 31 December 2020. ESMA also confirms that previously agreed Memoranda of Understandings (MoUs) on cooperation and information exchange concluded with the UK’s Financial Conduct Authority (FCA) remain valid and will come into effect at the end of the transition period. |

|

17 July

ESMA PROVIDES GUIDANCE ON WAIVERS FROM PRE-TRADE TRANSPARENCY

|

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, published an opinion providing guidance on pre-trade transparency waivers for equity and non-equity instruments. The document replaces the guidance of the Committee of European Securities Regulators and ESMA’s opinions on waivers from pre-trade transparency under the Market in Financial Instruments Directive (MiFID) I. |

|

16 July

ESMA publishes translations for Guidelines on liquidity stress testing in UCITS and AIFs

|

The European Securities and Markets Authority (ESMA) has issued the official translations of its guidelines on standardised procedures and messaging protocols. |