Vítor Constâncio: Growth in a more resilient Euro area

Remarks by Vítor Constâncio, Vice-President of the European Central Bank, on a panel entitled “The Global Economy: Prospects for Broad-Based Growth” at the 32nd Annual G30 International Banking Seminar, Washington D.C., 15 October 2017

Ladies and Gentlemen,

It is a great pleasure to be part of such a distinguished panel. In my remarks today, I would like to reflect on the euro area’s recent economic developments and prospects. In doing so, I will outline the role monetary policy has played – and will continue to play – in supporting the recovery, while also touching upon some of the additional policies required to firmly secure a self-sustained recovery.

The main message I would like to convey is that the euro area economy is experiencing a broad-based, robust and resilient recovery, which is underpinned by the monetary policy measures introduced by the ECB since June 2014. Despite this favourable growth dynamics, inflation developments have been subdued. We remain confident that the continued closing of the output gap will lead inflation to return to our medium-term objective, yet this return remains conditional on a very substantial degree of monetary accommodation.

Looking beyond monetary policy, considerable reforms have been implemented and institutional progress has been achieved since the crisis, but supply-side policies are still required at the national level to boost potential growth, while at the euro area level, further institutional reforms are needed to enhance the functioning of EMU.

Recent economic developments and prospects

In the second quarter of 2017, euro area real GDP expanded for the 17th consecutive quarter, growing by 2.3% year-on-year and exceeding our expectations from earlier in the year. Growth is also becoming more broad-based across euro area countries, showing the lowest dispersion since the beginning of the monetary union. The flow of survey data in the third quarter has been encouraging and bodes well for continued growth momentum in the period ahead.

Robust economic activity is also being translated into a substantial amount of job creation. Almost 7 million more people are now employed in the euro area than in mid-2013, which implies that all of the employment losses recorded during the crisis have been offset. The improving labour market combined with increasing household wealth, strong consumer confidence and favourable financing conditions should all support continued robust private consumption. Investment prospects also look promising, which reflects both the need to make up for forgone investment in previous years as well as the highly accommodative financing conditions which have been passed through to lower borrowing costs for euro area firms.

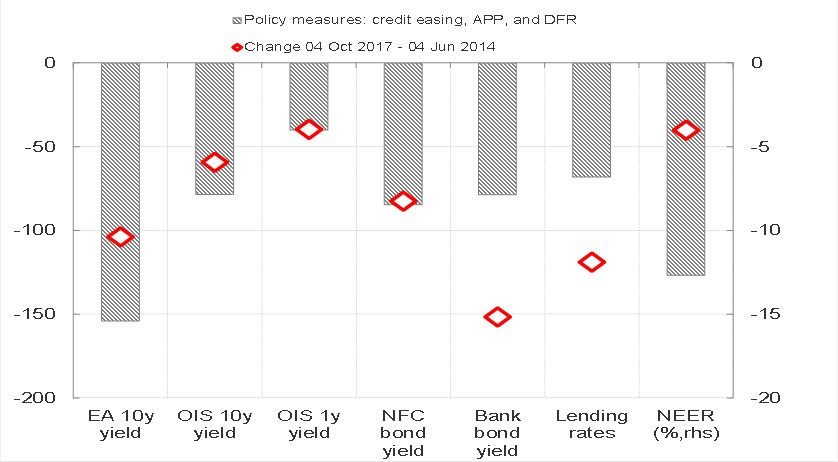

The resilience of the recovery reflects the strength of domestic demand which in turn, is being supported by the very favourable financing conditions stemming from the monetary policy measures introduced since June 2014 (see Chart 1).

Chart 1: Impact of ECB measures on key financing conditions

(contributions in basis points and percent)

Source: Bloomberg, ECB, ECB calculations.[1]

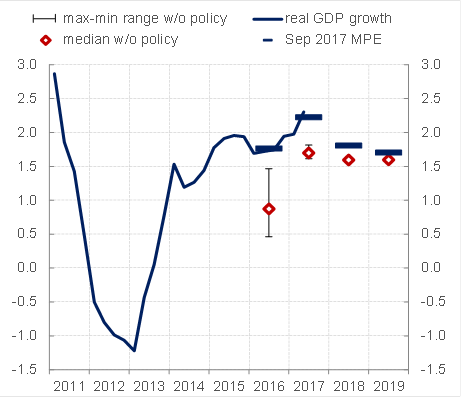

ECB staff counterfactual simulations indicate that absent our measures, GDP-weighted euro area 10-year government bond yields would, at present, be about 154 basis points higher and lending rates to NFCs about 68 basis points higher. ECB staff estimates indicate that our measures are contributing to an increase in euro area GDP of around 1.7%, cumulatively over the period 2016-2019 (see Chart 2) – well above monetary policy’s contribution to the two previous euro area recoveries in 2003Q2-2006Q4 and 2009Q3-2011Q3.

Chart 2a: Real GDP growth: actual, baseline projection and counterfactual without policy contribution

(year on year percentage change)

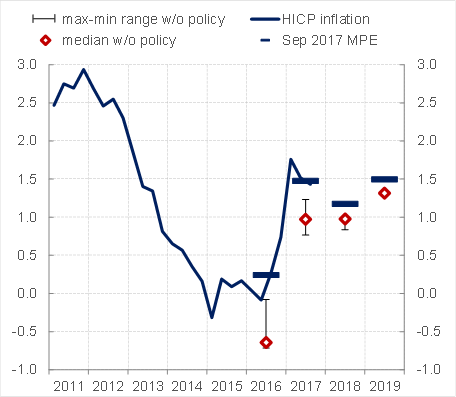

Chart 2b: HICP inflation: actual, baseline projection and counterfactual without policy contribution

(year on year percentage change)

Sources: ECB computations, SAPI Task Force, September 2017 MPE, BMEs.[2]

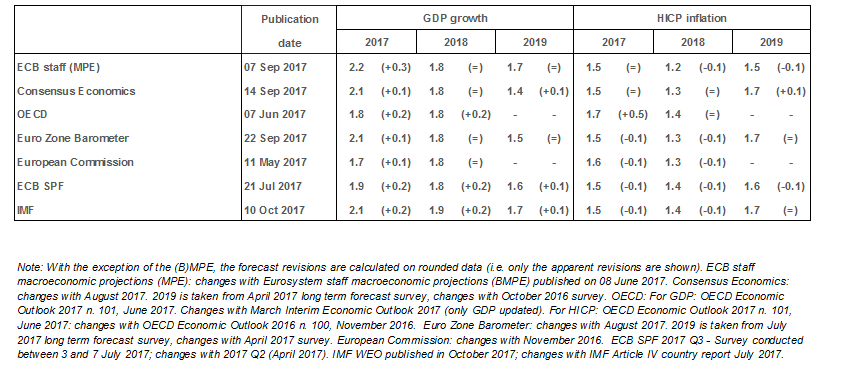

Looking ahead, the latest ECB staff projections continue to expect domestic demand to remain the key driver of euro area growth. Annual real GDP is projected to increase by 2.2% in 2017, 1.8% in 2018 and 1.7% in 2019. The risks to the growth outlook are broadly balanced. According to the latest IMF WEO projections, euro area real GDP is expected to grow by 2.1% in 2017 before moderating to 1.9% in 2018 and 1.7% in 2019, which is in line with the ECB projections.

Table 1: Comparison of forecasts for euro area real GDP growth

(annual percentage changes)

There are reasons to believe that the strengthening of economic activity, which so far has been significantly supported by accommodative monetary policy, will progressively be supported by more structural factors. Euro area governments have undertaken substantial policy actions and reforms to redress pre-crisis related macroeconomic imbalances and increase economic resilience.[3] For instance, euro area countries which had previously experienced large current account deficits are now in surplus. Moreover, both ECB staff and IMF estimates indicate that the largest driver of this adjustment is non-cyclical in nature, which implies a higher likelihood of sustainability as the recovery continues. Additionally, business cycle synchronisation across euro area countries has increased in recent years.[4] Finally, most countries that had large budget deficits have now positive primary surpluses. In sum, the euro area is now in a better state to withstand future economic or financial shocks.

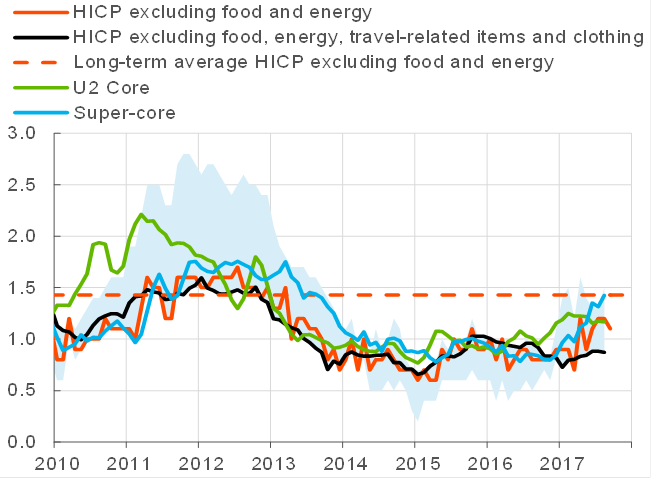

Despite robust growth dynamics, inflation developments have been subdued. Euro area headline inflation stood at 1.5% in September 2017, according to Eurostat’s flash estimate and is expected to temporarily decline towards the turn of the year owing to energy-related base-effects. Measures of underlying inflation have not yet showed convincing signs of a sustained upward trend (see Chart 3).

Chart 3: Measures of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations[5].

Looking further ahead and according to the latest ECB staff projections, inflation is expected to rise to 1.5% in 2017, 1.2% in 2018 and 1.5% in 2019. There are uncertainties clouding the medium-term outlook for price stability, most notably the recent exchange rate volatility, which requires monitoring with regard to possible implications for inflation dynamics. The inflation outlook from the recent IMF WEO depicts inflation at 1.5% in 2017 and 1.4% in 2018, which is broadly in line with ECB projections.

The apparent disconnect between strong economic activity, on the one hand, and low inflation and wages on the other, is one of the stand-out characteristics of the ongoing recovery.[6] From a policymaker’s perspective, a predictable relationship between slack and inflation represents a key monetary policy transmission mechanism through which central banks exert their effect on inflation dynamics.

While there is no agreed upon approach to estimating a Phillips curve linking inflation to slack, on the whole empirical estimates indicate that the slope is currently flatter than in the period preceding the crisis, with several explanations as to why this might be the case. One reason relates to the choice of slack measurement, as the crisis may have led to structural changes in the labour market. For example, when a broader measurement of unemployment is used (Unemployment 6, currently just below 18%) as opposed to the narrower definition (Unemployment 3, standing at 9.1%), the slope of the euro area Phillips curve appears to have become steeper in recent years. Other reasons proposed include: external factors including globalisation, the enhanced role of adaptive expectations in influencing wage and price decisions, anchored by central bank targets, and finally, non-linearities and time-varying behaviour of different Phillips curve coefficients. [7]

Overall, a steepening Phillips curve provides confidence that the continued closing of the output gap will gradually lead inflation to return to our medium-term objective. Yet, this return remains conditional on a very substantial degree of monetary accommodation.

It is against this background that the Governing Council will decide over the autumn period on a re-calibration of its instruments, with a view to safeguarding the monetary policy impulse that is still necessary to secure a sustained adjustment in the path of inflation, in a way that is consistent with our monetary policy aim.

Other policies

Notwithstanding the strength of the ongoing recovery, supply-side policies as well as institutional reforms are required in order to firmly secure a self-sustainable recovery and a better functioning euro area. Country level policies should be aimed at increasing productivity and facilitating innovation and business investment. Turning to Europe and European reforms, the most relevant ones concern the completion of Banking Union, meaningful progress in the Capital Markets Union and the creation of an additional budgetary stabilisation function for the euro area. Both the Five Presidents Report on “Completing Europe’s Economic and Monetary Union” (2015) and the recent EU Commission paper on the “Deepening of the Economic and Monetary Union” (2017), provide sufficient guidance on the way to proceed towards a stronger monetary union.