EIB Group activity in 2020: Spain the country with the greatest volume of financing approved for projects related to the COVID-19 crisis

- Spain was the first country to benefit from the European Guarantee Fund (EGF).

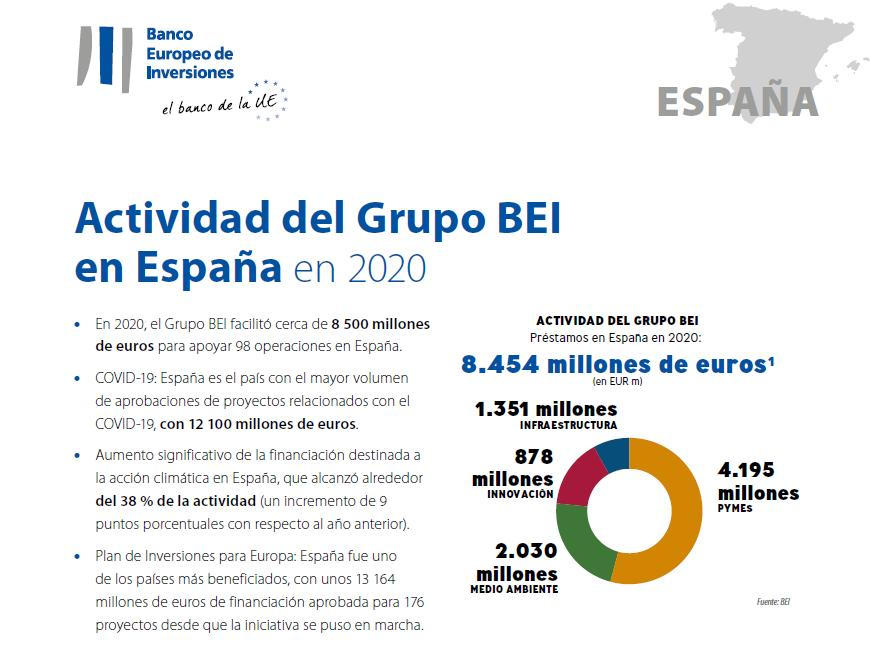

- Impact: nearly €8.5 billion for 98 operations in Spain, financing that amounts to nearly 0.8% of national GDP.

- Climate action: accounted for 38% of total activity, an increase of 9 percentage points compared to 2019.

- Investment Plan for Europe: Spain is the country with the third-highest volume of financing approved since 2015.

The European Investment Bank Group (EIB and EIF) today presented the results of its activity in Spain for 2020. Last year, the EIB Group signed 98 operations in Spain for a total volume of €8.454 billion, 58% of which dedicated to mitigating the economic and healthcare impacts of COVID-19.

At the press conference, EIB Vice-President Ricardo Mourinho Félix, who is responsible for the Bank’s activity in the country, explained: “2020 has been a tragic year that we will never forget. Spain has been one of the European countries most affected by COVID-19. For this reason, more than half of the financing provided by the EIB Group in Spain has been dedicated to tackle the healthcare crisis and to mitigate the economic effects of the pandemic, helping Spanish companies to keep their businesses afloat, preserving value and saving jobs. But this isn’t enough, and we will continue to work hard to slow the spread of the pandemic, to develop a treatment for the disease, to vaccinate the Spanish population, and to help Spanish companies to meet this challenge, as demonstrated by the numerous projects we are already working on for 2021. Despite giving our full support to combating the pandemic, we will not be forgetting about other key objectives on the European agenda. Intensifying climate action and protecting the oceans, fostering innovation and the digital transition remain key structural objectives for all the European institutions, working together to promote prosperity, employment and cohesion in Europe.”

COVID-19

The measures taken by the EIB to mitigate the effects of the pandemic focused on two main areas: supporting the healthcare sector and small and medium-sized enterprises (SMEs). With these objectives in mind, the EIB Group has signed 46 operations in Spain for a total volume of €4.9 billion and has approved operations worth €12.1 billion, making Spain the country with the largest volume of financing approved for projects related to COVID-19.

Furthermore, Spain has not only been the first country to benefit from the European Guarantee Fund (EGF), a fund provided with nearly €25 billion that aims to mobilise up to €200 billion in financing, but is also the country that has received the most approvals under the EGF, with projects approved for a total volume of €2.650 billion in 2020.

SMEs

The COVID-19 crisis has put even more emphasis on the urgent need to support SMEs, which represent a substantial part of the production and employment landscape in Spain. To this end, 50% of the EIB Group’s total activity in Spain was intended to meet the liquidity requirements of these companies, which received €4.195 billion to ensure that they have the funds required to keep their businesses afloat.

More financing for climate action in Spain

For the fifth consecutive year, the EU bank increased the percentage of its activity in the country aimed at promoting projects that contribute to climate change mitigation and adaptation, reaching 38% (€2.85 billion) of its activity in the country, a 9-percentage point increase on the previous year. Spain is the third-largest beneficiary of financing related to this objective in the EU. The EIB uses these funds to promote clean transport, energy efficiency, renewable energies, and to modernise the electricity networks, among other projects.

Investment Plan for Europe: results in Spain

2020 saw the end of the investment programme of the European Fund for Strategic Investments (EFSI), the main pillar of the Investment Plan for Europe.

Spain was the third main beneficiary of this initiative, both in terms of operations approved and investments mobilised. Between 2015 and 2020, the EIB Group financed 176 projects in Spain worth a total of €13.164 billion. This financing intends to mobilise around €63 billion of investment in Spain, which will primarily contribute to foster climate action, innovation, sustainable production, cutting-edge digital technologies, and competitiveness for Spanish companies.

Support for infrastructure

The financing provided by the EIB for the development of new infrastructure in Spain throughout 2020 grew to a total of €1.351 billion, which is a 45% increase compared to the previous year. As part of this objective, the EIB is helping to adapt and modernise the Spanish healthcare infrastructure in response to the COVID-19 crisis, to develop railway infrastructure towards cleaner modes of transport, and to promote the construction of social housing among other priorities.

Overall EIB Group results

Overall financing from the EIB Group in 2020 reached €76.8 billion (an increase of 6% compared to the previous year), with €66.09 billion provided in the form of loans provided by the EIB and €12.87 billion provided via the European Investment Fund (EIF), the subsidiary of the EIB that specialises in providing solutions to financial intermediaries to support SMEs and to promote innovation in Europe.

One third of the total financing from the EIB (€25.5 billion) was used as part of the immediate response to the crisis resulting from the COVID-19 pandemic. Most of this was provided to SMEs to prevent insolvency and job losses.

In 2020, the EIB kept its promises to increase green investment and to become the EU climate bank. The share of investments intended for environmental and climate sustainability projects increased from 34% to 40% last year. This brings the EU bank closer to the objective of dedicating 50% of its total lending activity to combating climate change, in line with the objective set in the Climate Bank Roadmap adopted by the EIB in November 2020.